This article explains what equity crowdfunding is, how it works, and the opportunities and risks for Australians interested in investing in unlisted Australian businesses.

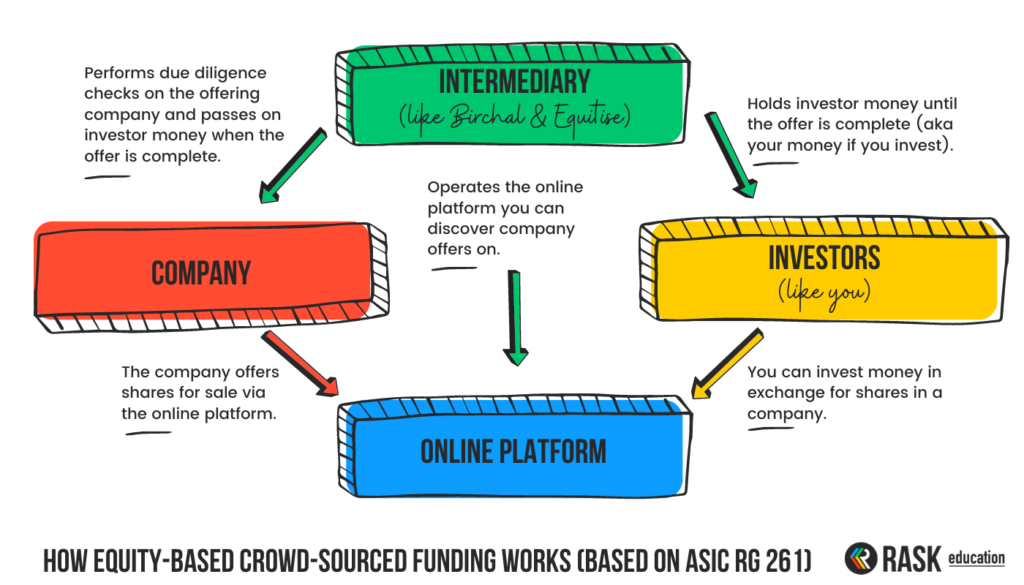

ASIC defines equity crowdfunding as something that ‘involves a company raising funds—usually through an online intermediary—from a large number of individual investors who make relatively small financial contributions to the company’. Essentially, you can buy a small piece of a private or unlisted company in exchange for your hard-earned cash. Just like that, you’re the part-owner of a new medical device or skincare company!

I had the opportunity to chat with Matt Vitale, the CEO of Birchal, an Australian equity crowdfunding platform, about how it all works and why crowdfunding is starting to emerge in Australia now.

Crowdfunding vs Kickstarter

The fundamental difference between equity crowdfunding and other platforms that you may be familiar with, like Kickstarter, Pozible and Indiegogo, is that equity crowdfunding involves issuing shares to investors, rather than providing them with a ‘reward’ of sorts.

It’s a fairly new industry in Australia, but Matt says equity crowdfunding platforms emerged in the UK after the GFC, and they’re now a credible and widely accepted way for early-stage businesses to raise funding in the UK.

Australian equity crowdfunding regime

One of the prominent game-changers from the Australian equity crowdfunding regime Matt highlighted is that, historically, when businesses were raising capital, they wouldn’t be able to advertise their offers online. So they were limited to the people that they could get in contact with, like their own closed networks, angel investors, venture capital funds and the like.

The Australian equity crowdfunding regime now allows platforms like Birchal to facilitate capital raisings among retail investors online, in a substantially simpler way.

“The other game-changer is that proprietary limited companies or private companies can have a potentially unlimited number of investors through an equity crowdfunding offer. Previously, a company would need to convert to a public structure once they had more than 50 non-employee shareholders. But under the crowdfunding regime, you don’t include anyone that’s acquired their shares via a crowdfunding offer for the purpose of that test. So, we have some private companies that have literally 1000s of investors” comments Matt.

Equity crowdfunding presents a “range of really compelling opportunities, particularly for businesses that have a strong consumer proposition because it’s not just about the money that they’re raised, but they’re building an army of brand ambassadors” continues Matt. This provides investors with an exciting way to engage and be involved with the businesses and companies they feel aligned with.

Current crowdfunding platforms in Australia

Since equity crowdfunding platforms were opened up to retail investors, there have been a number popping up across the country. Here are some notable ones currently operating in the Australian market for you to investigate:

Risks of investing in companies through crowdfunding platforms

I feel like I’m always bursting new investors’ bubbles when I start talking about investment risks, but they’re real, and they’re critical to consider when investing in equity crowdfunding offers. Due to the risks involved in investing in small companies, ASIC specifies there must be a risk warning statement on the platform and offer documents to make sure you understand the risks.

So, what are some key considerations you should be aware of?

- Less liquidity – aka you can’t just sell the shares and get your money back on your own terms.

- Less due diligence and transparency – unlike an IPO, companies that are crowdfunding don’t have to go through the same level of public and regulatory scrutiny to offer their shares for sale.

- Increased risk of company failure – there’s an increased risk of losing all your money when investing in small and emerging businesses.

According to ASIC, some common risks for an early-stage or start-up business include:

- Market & competition risk (e.g. unproven market demand for their product or service)

- Failure to secure or loss of key employees, customers or suppliers

- Early termination of an important contract

- Unable to obtain finance

- Failure of technology required to successfully design, manufacture and market the product

- Loss or timetable implications due to an inability to obtain regulatory and other approvals

Selling your shares & making a profit

When you invest in a company already listed on the Australian Securities Exchange (ASX), the process of selling your shares is fairly simple (and comparable to the process of buying shares). However, with equity crowdfunding, the way into the investment will appear very different to the way out.

The process of realising the capital gains (or losses) on your investment will be different depending on the company and the path they take, so I’ve highlighted a few potential realistic exit points.

- Initial Public Offering (IPO) – if the company decides to go public on the ASX, you’ll be able to sell your shares through any Australian broker.

- Acquisition – a large company may wish to purchase the company you’ve invested in, and you’ll receive payment for your shares.

- Liquidation – the company folds and your shares are worthless. You can talk to an accountant about the possibility of realising a capital loss on your investment.

TLDR: Equity crowdfunding provides a way for investors like you and me to invest in private companies. Make sure you understand the risks, do your own research and don’t invest more than you’re prepared to lose. This is a high-risk investment.