Over at Rask Education, we talk about investing a lot, and I mean a lot. Between our free podcasts, courses and articles, we’ve got it covered. However, the one thing we don’t consider often is when you shouldn’t invest.

And I think that’s a pretty important discussion to have.

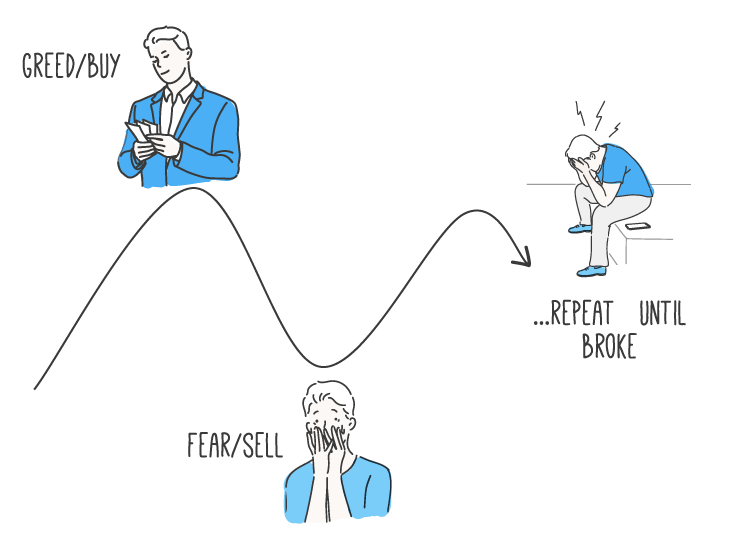

Thinking about some of these reasons is a great way to give yourself a reality check because investing involves risk, and that’s not always easy to bear.

Risk is the possibility that you’ll end up with a less than optimal result, and when it comes to investing, there are countless variables that can increase and decrease your exposure to risk.

But the more educated and prepared you are before diving in, the more you’ll be able to deal with the curveballs that the market pitches your way.

So let’s dive into the reasons why you shouldn’t be investing…

Reason #1 – You’ve got debt coming out of your ears

If you’re dancing with credit cards, personal loans, payday lenders and BNPL providers, paying them off and shutting the accounts, should absolutely be your first priority.

Paying off debt can be a long and arduous process, but getting the past off your back before investing in your future is an important first step. With interest rates for consumer debt ranging from 8% to over 20%, you’ll make much faster progress if you prioritise paying them off ASAP.

For more resources on paying off debt, check out our free Money & Budgeting Course for insights into developing a budget and paying off your debts. Alternatively, get in touch with a free financial counsellor, they’re a fantastic resource to help you along the path out of debt.

Reason #2 – You don’t have an emergency fund

Fondly known as a F-Off fund, this is what’s going to help you sleep soundly at night, regardless of what life (and the market) throws at you.

Having 3-6 months of basic living expenses set aside in a dedicated savings account might sound like a lot when you’re just getting started, but you’ll be mighty glad of it when sh*t hits the fan. Putting this cash aside should be your first port of call, as you don’t want to be forced to sell your investments in a high pressure situation.

Reason #3 – You don’t understand the basics of investing

I don’t know if you can ever truly understand investing. There’s a never-ending stream of things to learn and new information to take in. But, the basic principles of investing remain the same and have done so since the beginning.

These include ideas like:

- Spend less than you earn

- Invest the rest in high-quality companies and ETFs

- Understand the stock market is volatile and risky

- Invest with a long-term timeframe

Have a read of our investment philosophy to learn about our approach to investing.

Reason #4 – You’re playing with fire (not the good kind)

Stop! Are you planning to invest money you’re going to need in a few months for a vacay or a house deposit in the next year or so? If so, it’s not a great idea to start investing your money and you’re better off keeping it in a savings account.

The longer your investment timeframe (5-10 years minimum), the more time you have to ride the rollercoaster that is the stock market.

Reason #5 – You haven’t done the work and you’re not prepared to accept your mistakes

You might know that you shouldn’t invest in anything you don’t understand and if not, here’s your reminder.

You need to do the work to research and understand the investment product before you commit your hard-earned dollars. Whether that’s looking into a company’s management style or reading the ETF’s Product Disclosure Statement (PDS), you have to put in the time required to understand what you’re doing.

This will help you deal with market risk and volatility with a much more level head, and you won’t be pushed around by dramatic media headlines.

Plus, when things go wrong and mistakes are made, you’re probably going to look for someone to blame. If you’re not prepared to embrace and learn from your mistakes, then you’re not ready to invest yet. It’s as simple as that.

So what can you do to make sure you’re ready to invest?

- Make a plan and pay off any debts you might have

- Set a goal and save up your emergency fund

- Learn about the basics of investing in our free beginner ETFs and Shares courses

- Make sure you’re only investing with a timeframe of 5-10 years and over

- Do the necessary research to understand what you’re investing in

Plus, learn more about the basics of investing in shares and ETFs, in our free courses!