EPS stands for earnings per share in investing.

Since “earnings” is another word for “profit”, think of it like “profit per share“.

EPS represents the amount of yearly profit per individual share.

How do I calculate EPS?

There are some confusing formulas in textbooks but EPS is simply the total profit made by a company during a year, divided by the number of shares.

For example, if High Rollers Company made $100m of profit last year and it has 100m shares its EPS would be ($100m/100m shares) or $1.

If Bad At Business Pty Ltd made a $20m loss last year and has 10m individual shares, it would have negative EPS of $2!

(if you think about it, you can’t have negative profit — it would just be a “loss” — but, hey, it’s finance)

In practice, you can calculate EPS by going to a company’s annual report and finding its Income Statement. Near the bottom, it will have ‘net earnings (also called net income or net profit).

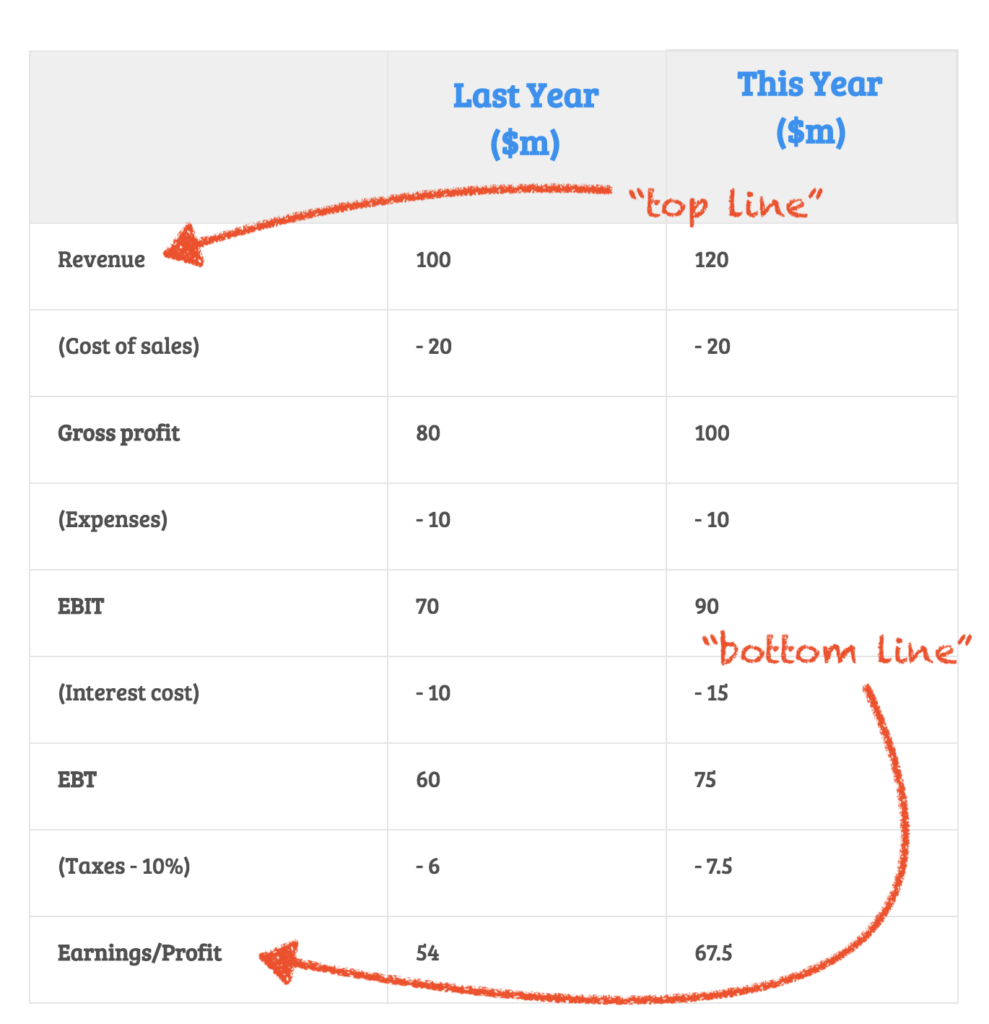

Example Income Statement

In the image above, profit is the “bottom line”.

Where do I find the number of shares?

The easiest way to find the number of shares outstanding is by going into the Annual Report (usually, it’s a PDF) and searching the document for “shares outstanding” or “diluted” (tip: press CTRL + F on your keyboard, or CMD + F for Mac to search).

Somewhere in the annual report you’ll see afigure for the diluted shares outstanding at the end of the financial year. That’s your denominator (the bottom part of the EPS equation).

For example, using the income statement above, you can see the company made a net profit of $54 million this year. Let’s say the company had 10 million diluted shares outstanding. Its EPS would be $54m / 10m = $5.40 per share.

The difference between DILUTED and BASIC EPS

Sometimes you’ll see basic EPS and diluted EPS in an annual report or broker statement. The difference between diluted and basic EPS lies in how many shares are included in the calculation.

Basic earnings per share uses normal/common shares only. But that might not tell you everything you need to know.

Diluted earnings per share uses normal shares, but adds shares that are not yet trading on the market (options, bonuses for employees, etc.) as well as special or preferred shares.

It is best practice to use diluted earnings per share because that shows you the ‘whole picture’. Some companies will come up with complicated reasons why ‘basic is better’.

But, at the end of the day, you should be calculating EPS as if everyone who owns some type of equity (normal shares, preferred shares, options, etc.) has a right to the company’s profit.

Basically, use diluted EPS (see what we did there?).

Using EPS to value stocks/shares

If you want to know more about how EPS can be used to value stocks/shares/businesses, click on one of the following links:

- (Free) Introduction to Shares & Investing Course

- Using the price-earnings (P/E) ratio

- (Free) Advanced Valuation Course

[ls_content_block id=”27643″]