Imagine you own an apple farm and you buy a $50,000 tractor today.

It’s a red tractor with stripes — so you know it’s cool.

Apples To Apples, Not Apples to Tractors

For your apple business you also need to buy fertiliser to help your plants grow faster. You typically use up all of your fertiliser in the first day, and you buy more every two weeks.

Your accountant would record fertiliser as a “Cost of Doing Business” because it’s a direct input to your business.

If you, the best apple farmer in all the lands, sold $100,000 of apples (revenue) and you paid $20,000 for fertiliser (cost), you would be left with $80,000 in gross profit.

That’s how you ‘account’ for costs that your business uses up everyday day, week or year.

But a tractor is not a Cost Of Doing Business (or “COGS” for short) because the tractor will be used for many years — not in one day like the fertiliser was.

Let’s imagine the tractor has a ‘useful farm life’ of 5 years.

After that, it will be put in the yard to rust.

Meaning, the tractor is an ‘investment’ in the farm over many years.

How Is The Tractor Reported On The Balance Sheet?

If you want to geek out, your new tractor is recorded as a $50,000 Asset under the “property, plant and equipment” (PPE) account on the farm’s Balance Sheet.

Introducing Depreciation

Because your cool, red, stripey, apple-making tractor will be used over 5 years we need to introduce a new yearly “cost” called depreciation.

Remember how we said your tractor cost you $50,000 upfront?

Well if you’re going to use it for 5 years, it’s going to “cost” the business the equivalent of $10,000 per year.

That is, $50,000 (the upfront cost) / 5 years (useful life) = $10,000 per year (depreciation).

The $10,000 of depreciation is your new yearly cost for the business.

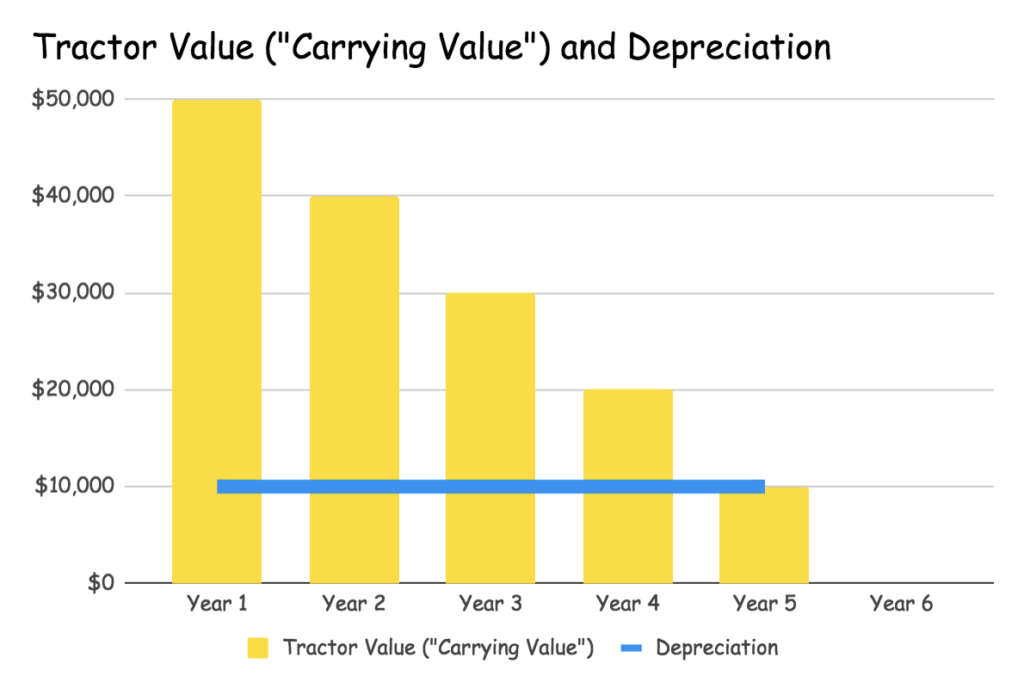

Each year, you’ll incur a cost of $10,000 for Depreciation (which can be shown on the Income Statement) and the value of the tractor on the Balance Sheet is reduced by $10,000. That is, the depreciation reduces the value of the tractor from the year before.

By the sixth year (five years from today), your tractor has a “Carrying Value” of $0 (this is sometimes called the “salvage value”). Look at this chart:

Straight Line Vs. Accelerated Depreciation

The example we just used is called “straight line depreciation” because the yearly cost of depreciation is flat (like a line). Look again at the chart above.

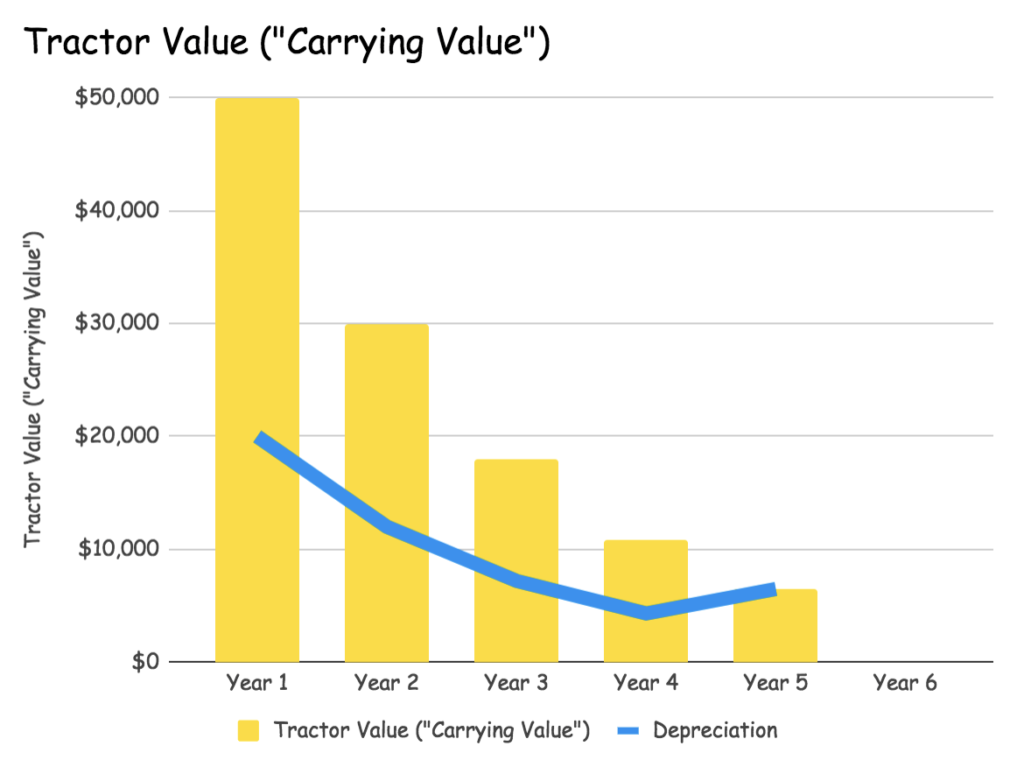

We can also do something called “accelerated depreciation“. Commonly, some businesses will depreciate the value of an asset (e.g. a tractor) quicker in the first few years.

For example, “double declining balance method” doubles the cost of depreciation in the first year.

In our example, the tractor’s depreciation ‘cost’ was 20% of the purchase price. That is, $10,000 / $50,000 = 20% of the upfront value is depreciated each year.

Using the double-declining method, we can double the percentage of depreciation to 40% ($20,000 of depreciation in the first year).

Then, we use 40% of the previous year’s ‘carrying value’ until we get to the final year (year 5 in our example). At that point, we can use the straight-line method to take the ‘carrying value’ to zero (or the salvage value). Like this:

Amortisation Vs. Depreciation

Amortisation is the same as depreciation, except it is used for assets that are NOT physical/tangible. These are called “intangible assets”.

For example, in the computer industry, amortisation could be applied to the costs of creating software. It might also include trademarks, copyrights or patents which will eventually expire.

However, some ‘intangible assets’ like goodwill or brand value have unlimited lives (e.g. a brand doesn’t expire like a patent does), so they are NOT amortised but are instead valued regularly to determine if they have risen or fallen in value.

Note: In banking, amortisation can also refer to the falling value of a loan which is paid off regularly (e.g. every month).

[ls_content_block id=”27643″]