Please note we have released a more recent version of the Value Investor Program. This one is still amazing (and free!), but it is the slightly older version.

Click here for the new one, or enrol in this one for free.

Already a member? Head here to continue your course.

This online course includes the full Rask Value Investor Program material and curriculum. The Value Investor Program is designed for:

- Finance students – who want to ace an interview and ‘talk the talk’ (but also see how research is approached in the real world)

- Private investors – this program will round out the experience that comes with years of part-time investing

- Finance professionals – professional analysts and portfolio managers have taken this course to improve their skills and knowledge (your boss might even pay for it!)

- Career changers – this program assumes some knowledge but not much, offering great insights for those transitioning to a finance or investment role

- Business owners, executives and managers – good businesses attract good investors and good business people know what makes a good investment opportunity. Therefore, the benefits from this program will be two-fold for business owners and managers

The concepts discussed in this program are of an ‘advanced’ level. However, most of the lessons and topics will be manageable and understandable for people who have been investing in some form for, say, 12 months or more.

The technical difficulty of the program increases as you go, meaning the first lessons are very approachable and are arguably the most valuable.

Towards the end of the program, students finish with a walk-through of the valuation process and modelling techniques and are given real-world approaches to what we’re taught in academia.

A basic level of accounting or financial knowledge is assumed. For example, if you understand the basic flow from top to bottom of an income statement (e.g. revenue minus costs equals gross profit) and/or you know the basic differences between the cash flow statement and income statement (i.e. one is cash, the other uses accrual accounting) — that will be enough to get by in this program.

While that may seem like a low (or high!) hurdle for some, almost everyone can benefit from this program because we cover so much that’s not necessarily about financial statements and math. Here are the high-level topics covered in the program:

- Investment philosophy

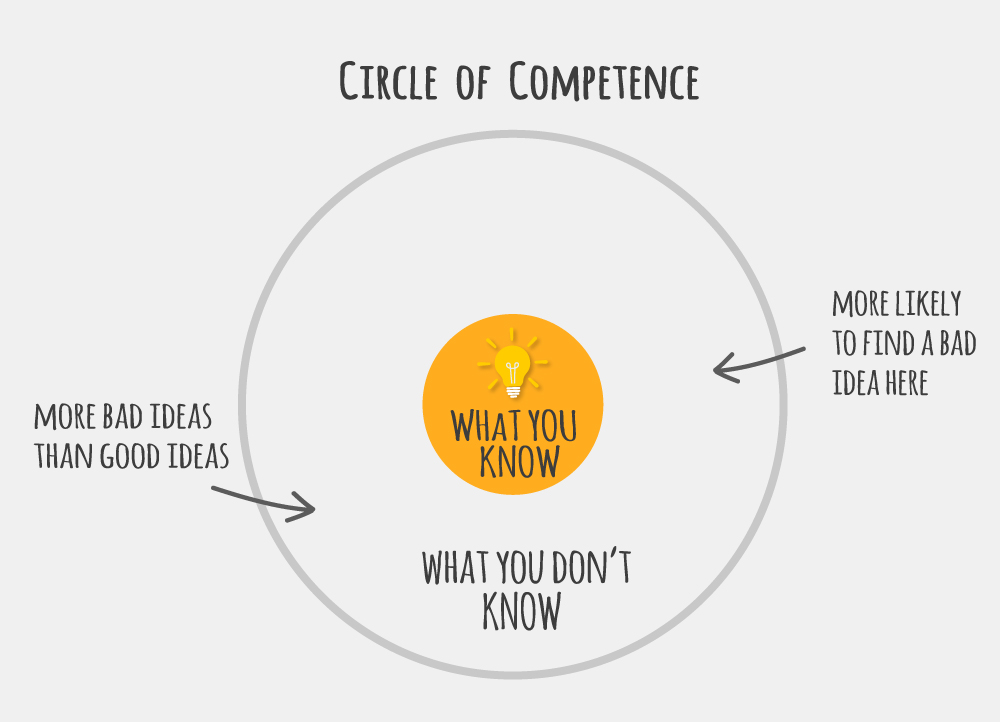

- Psychology & essential mental models for long-term investing

- Building your own investment process from the ground up

- Assessing a business’s competitive advantage & moat

- Management incentives, bias & culture (and how to test it)

- Common accounting traps & hidden opportunities in financial statements

- Valuation & modelling, and

- Portfolio management

Course length: Go at your own pace!

FAQs

Is the program online?

Yes. You can enrol, begin and finish the program right now.

How long does it take to complete the course?

It depends on your time, experience and energy but there are 10-12 hours of videos, spreadsheets and examples to work through, plus quizzes. Some people have completed it in just 3 days, others commit an hour each week for 2-3 months.

Can I download the materials?

Yes, all of the spreadsheets and slides are downloadable and can be used in Microsoft or Google Sheets/Drive format.

Are there any exams or tests?

There are no exams, “must-pass” tests, or trick questions. We have added short self-paced questions throughout the program but these are designed purely for you to test your own understanding. There are no pass or fail marks.