Diversification is a portfolio management technique used to lower the risk of an investment portfolio.

2 types of investing risk

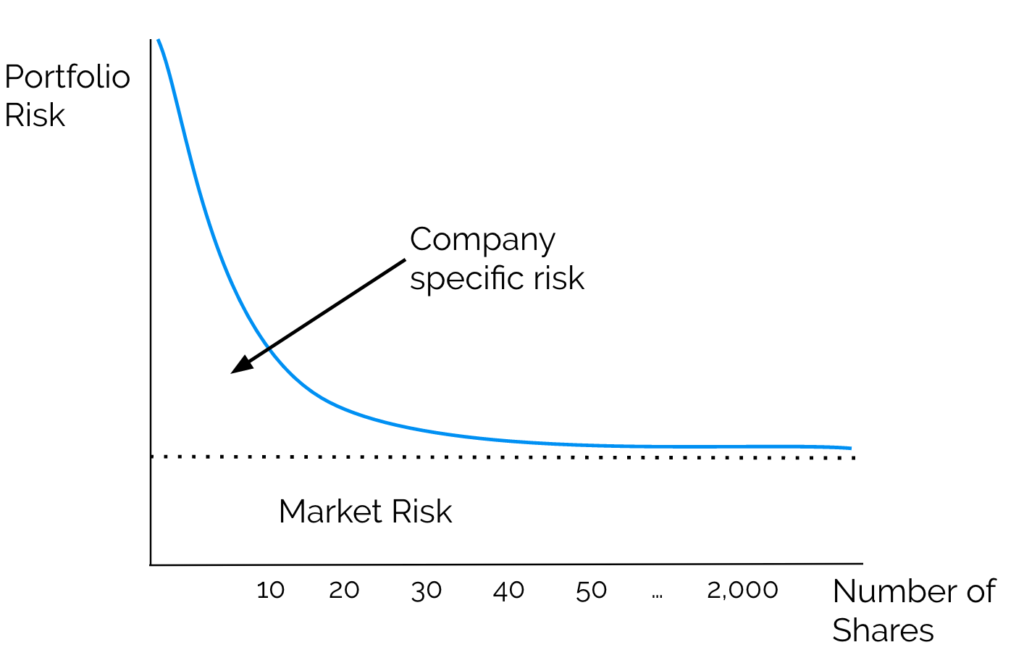

As defined by academic theory, there are two types of risk:

- Specific risk (also called diversifiable risk)

- Market risk (also called undiversifiable risk)

Company specific risk can be reduced by diversification. These are risks specific to a company or industry.

For example, let’s say an investor holds shares in 10 gold companies. Tomorrow, the price of gold falls, so the entire portfolio will be adversely affected. If, however, the investor held 1 gold company and 9 other diverse companies, the specific risk (i.e. a falling gold price) can be reduced.

Market risk cannot be completely reduced. An example of the market risk is the general ups and downs of share prices. This is the risk of the market.

Diversification narrows the range of return outcomes. However, it doesn’t necessarily reduce the expected return.

Consider This:

In a diversified portfolio, the overall portfolio cannot perform better than the best-performing investment. However, it cannot perform worse than the worst-performing investment.

“Don’t put all your eggs in one basket”

Evans and Archer (1968) found that 10 diversified investments were enough to remove 70% of the diversifiable risk, while Statman (1987) found that 30 to 40 stocks are required to be well diversified.

How to diversify my investments

An investor can diversify a portfolio by holding investments across different asset classes, including:

- Shares

- International shares

- Bonds

- Cash

- Property; and

- Alternative investments

For example, consider an investor who owns their family home and their only investment is another property. That would be an example of poor diversification.

An investor can also diversify within an asset class (see the gold investor above example, above).

Podcast: How do I diversify quickly and easily?

In the following Australian Finance Podcast episode, Kate and Owen explain in simple terms how to diversify your portfolio across shares, bonds, ETFs, gold, cash and more.

See: How to diversify ALL of your finances

[ls_content_block id=”27643″]